In today’s complex business environment, financial transparency and accountability are more critical than ever. Organizations, whether large corporations, small businesses, or non-profits, are expected to maintain accurate financial records and comply with regulatory requirements. One of the most effective ways to achieve this is through an external audit.

What is an External Audit?

An external audit is an independent examination of a company’s financial statements, conducted by an external auditor. Unlike internal audits, which are performed by in-house teams, external audits provide an unbiased and objective assessment of a business’s financial position. The goal is to ensure accuracy, compliance with accounting standards, and the fair representation of financial statements.

The Need for an External Audit

1. Compliance with Legal and Regulatory Requirements

Many businesses are legally required to undergo an external audit to comply with financial regulations. Regulatory bodies and tax authorities mandate audits to ensure financial statements adhere to accounting standards and legal frameworks.

2. Enhancing Financial Credibility

A company with audited financial statements gains trust from stakeholders, investors, banks, and regulatory authorities. An external audit provides assurance that the financial information presented is accurate and reliable, enhancing the organization’s reputation.

3. Prevention and Detection of Fraud

Financial fraud is a significant risk for any business. External auditors critically examine financial records and internal controls, helping to detect any inconsistencies, misstatements, or fraudulent activities. This promotes financial discipline and safeguards assets.

4. Improved Internal Controls and Efficiency

External audits provide valuable insights into a company’s internal control systems. Auditors identify weaknesses and recommend improvements, leading to enhanced operational efficiency and risk management.

5. Strengthening Investor and Lender Confidence

Investors and financial institutions rely on audited financial statements to assess the financial health of a business. A positive audit report increases investor confidence, facilitates access to funding, and strengthens a company’s market position.

6. Ensuring Business Continuity and Growth

By providing a clear financial picture, external audits help management make informed decisions. This supports strategic planning, long-term sustainability, and business expansion.

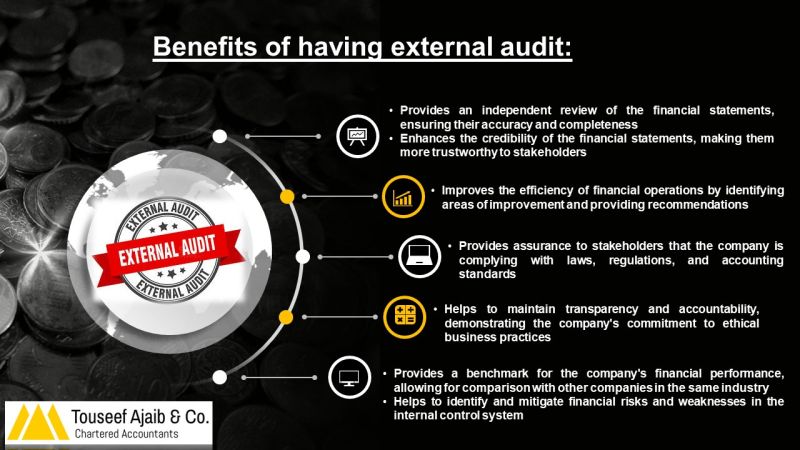

Key Benefits of External Audit

- Objectivity and Independence: External auditors offer an impartial review, free from internal influence, ensuring credibility.

- Risk Mitigation: Identifies financial risks and inefficiencies, helping businesses take corrective actions before issues escalate.

- Stakeholder Assurance: Builds confidence among shareholders, employees, customers, and regulatory bodies.

- Better Corporate Governance: Encourages ethical business practices and accountability.

- Tax Compliance: Ensures accurate tax calculations and reduces the risk of penalties or legal action.

Conclusion

An external audit is not just a regulatory requirement but a valuable tool for businesses aiming for transparency, credibility, and financial stability. It enhances corporate governance, mitigates financial risks, and builds trust among stakeholders. In an era where financial integrity is paramount, businesses that embrace external audits position themselves for sustainable growth and success.