In today’s competitive business landscape, financial management is crucial for survival and growth. Whether you run a small startup or a well-established enterprise, proper bookkeeping and accounting serve as the backbone of your financial health. Many businesses fail, not because they lack customers or a great product, but due to poor financial management. This highlights the need for accurate bookkeeping and efficient accounting practices.

What is Bookkeeping and Accounting?

Bookkeeping is the process of recording daily financial transactions, including sales, purchases, receipts, and payments. Accounting, on the other hand, involves summarizing, analyzing, and reporting financial data to help in decision-making. While bookkeeping ensures that records are accurate and up to date, accounting interprets this data to provide meaningful insights into a business’s financial position.

Why Proper Bookkeeping and Accounting Matter

1. Financial Clarity and Control

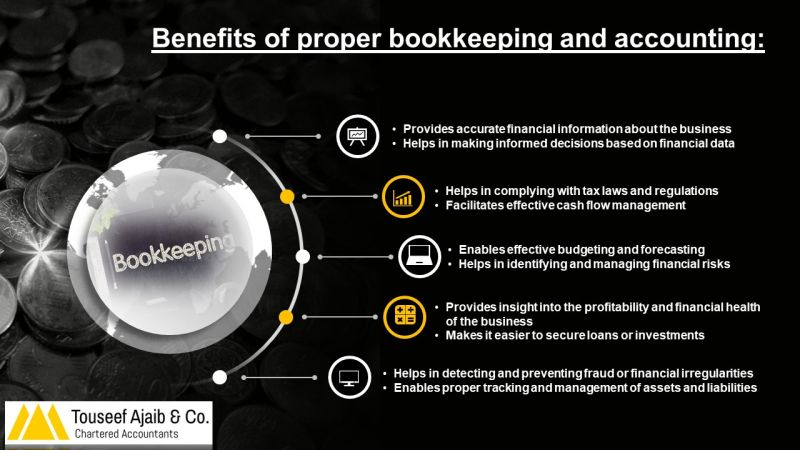

One of the primary benefits of proper bookkeeping is maintaining clear financial records. A well-organized bookkeeping system allows businesses to track revenue, expenses, and profitability. It helps business owners understand their financial standing, preventing overspending and ensuring sustainable growth.

2. Legal and Tax Compliance

Businesses are required to comply with tax laws and financial regulations. Without accurate records, calculating and filing taxes becomes a daunting task, increasing the risk of penalties and audits. Proper bookkeeping ensures timely and accurate tax filings, keeping businesses compliant with regulatory authorities.

3. Informed Decision-Making

Sound financial decisions are only possible when businesses have reliable data. Accurate accounting records help in budgeting, forecasting, and strategic planning. Whether it’s expanding operations, hiring new employees, or cutting costs, having a well-maintained accounting system provides the necessary insights to make informed choices.

4. Easier Access to Loans and Investments

For businesses seeking financial assistance from banks or investors, proper bookkeeping and accounting play a crucial role. Financial institutions require well-documented financial statements before granting loans. Similarly, investors look for transparency and financial stability before funding a business. Organized financial records increase the credibility and trustworthiness of a company.

5. Fraud Detection and Risk Management

Without proper financial controls, businesses are vulnerable to fraud and mismanagement. Regular bookkeeping and accounting help in identifying discrepancies, unauthorized transactions, and financial irregularities. This reduces the risk of losses and ensures that the company’s finances are secure.

6. Business Growth and Sustainability

A business that lacks financial discipline struggles to grow. With effective bookkeeping and accounting practices, companies can identify profitable areas, cut unnecessary expenses, and allocate resources wisely. This leads to long-term financial stability and scalability.

Conclusion

Proper bookkeeping and accounting are not optional but essential for business success. They provide financial clarity, ensure compliance, support decision-making, and enhance business credibility. Investing in professional bookkeeping and accounting services can save businesses from financial pitfalls and position them for sustainable growth.

In an era where data-driven decisions define success, businesses that prioritize proper financial management gain a competitive edge. Therefore, whether you’re a startup or an established enterprise, ensuring accurate bookkeeping and accounting should be a top priority.